The OPay vs. Kuda Transfer Experience: A Story of Two Journeys

It’s a busy Monday morning. Ada needs to send money to her brother, who just called in a panic because his rent is due today. She sighs, picks up her phone, and opens two fintech apps: OPay and Kuda. Which one will make her life easier?

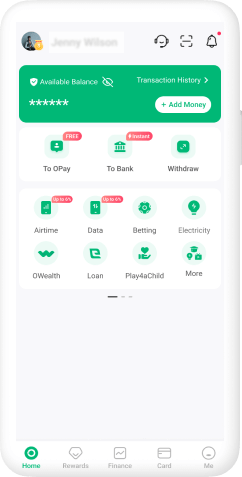

Onboarding & Discovery: The Search for the Transfer Button

Ada starts with OPay. She hesitates for a moment, where’s the transfer button? The label isn’t as clear as she expected. But within seconds, she notices the different transfer options available, including sending to an OPay wallet or other banks. It’s neatly laid out, and her recent transactions are displayed right there on the transfer page. “Nice,” she thinks. If she were sending money to someone she has sent to before, this would be quick.

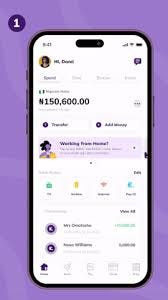

She then switches to Kuda. Immediately, she sees a clear, intuitive CTA guiding her to start the transfer process. “That’s smooth,” Ada nods approvingly. But as she taps on the “SEND” button, she frowns. The flow is different from the other CTA “TRANSFER” she saw earlier. This one feels confusing, as she struggles to understand the information hierarchy. “Why does this feel so different from the other way to transfer?” she wonders.

The Transfer Process: Speed vs. Frustration

Deciding to proceed with OPay first, Ada enters her brother’s account number. Instantly, the app suggests the bank, and she doesn’t have to type it in manually. “That’s a relief,” she mutters. The double confirmation for first-time transactions reassures her that she’s sending money to the right person, and she notices a fraud flag feature. “Good to know they care about security,” she thinks. But just as she’s about to send, she wonders about the transfer fee. There’s no clear breakdown. “Wait, am I getting charged for this?”

Moving to Kuda, Ada sighs as she realizes she has to manually select the recipient’s bank before entering their account number. “That’s an extra step I didn’t need,” she grumbles. The load time is slower than she expects, making her tap impatiently on the screen. But she appreciates one thing is that Kuda makes transfer narration compulsory, which will help her track her finances later. She also notices that Kuda offers 25 free transfers per month, a great deal compared to OPay’s three free transfers per day.

Security & Confirmation: Who’s Watching Out for Me?

OPay asks for her PIN before completing the transaction. Good. But what really impresses Ada is the confirmation screen. She can see all recipient details before she hits send and no chance of sending money to the wrong person.

Kuda also requires a PIN for security, but something’s missing, there’s no final confirmation screen. Ada feels a slight unease. “What if I made a mistake? Shouldn’t I get one last chance to review?” she thinks.

Feedback: The Last Mile Matters

Boom. The money is sent, and Ada sees an immediate confirmation on OPay. But what really stands out is the network monitoring system, she’s informed of the bank’s network status. “This is great,” she smiles, appreciating the real-time updates. She also notices that she can share the receipt immediately or save the recipient as a favorite for the future.

Kuda, too, provides instant feedback. But there’s one glaring issue after the transaction is completed, Ada finds herself stuck. There’s no automatic navigation back to the dashboard. She has to manually exit the screen. It’s a small inconvenience, but at the moment, it’s frustrating.

Final Thoughts: Who Wins the Transfer Battle?

Both OPay and Kuda offer strong transfer features, but each has room for improvement.

🔹 OPay shines in:

- Seamless four-step transfer process with auto-suggest for banks

- Double confirmation for first-time transactions

- Strong fraud prevention and security confirmation

- Real-time network monitoring for better feedback

🔸 Where OPay can improve:

- More transparent transfer fee display

- Better customer service support

🔹 Kuda excels in:

- Clear and intuitive onboarding experience

- 25 free transfers per month (compared to OPay’s daily limit)

- Mandatory transfer narration for better financial tracking

🔸 Where Kuda falls short:

- Slower load times and extra steps for selecting a bank

- No final confirmation screen before completing a transaction

- Poor flow ending requiring users to manually return to the dashboard

As Ada reflects on her experience, she realizes both apps have strengths. But in a fast-paced world where every second counts, small friction points can make all the difference. For now, she decides she’ll stick to OPay for speed and ease but hopes Kuda refines its experience soon.

Which app would you choose?

#UXWriting #Productanagement #Productteardown